Insight Associates

Company Snapshot

Garry Mumford, Founder and Managing Director at Insight Associates, discusses what led to their decision to implement iplicit

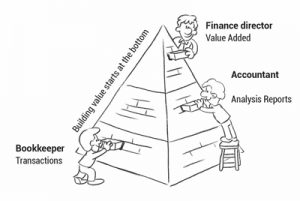

What is Insight’s core business proposition? Primarily, Insight Associates delivers a turnkey Outsourced Finance Department; we run the entire finance and accounting functions on behalf of all our clients. We focus upon high growth businesses that are moving quickly and we remove the burden of all the granular day-to-day accounting issues and provide them with actionable management information. Our whole proposition is focused upon adding value, using a pyramid model of accounting and financial management. Removing all the mundane detailed bookkeeping tasks from the bottom of that pyramid; produce management reporting in the middle; and most importantly, advising in a Finance Director capacity at the top.

Primarily, Insight Associates delivers a turnkey Outsourced Finance Department; we run the entire finance and accounting functions on behalf of all our clients. We focus upon high growth businesses that are moving quickly and we remove the burden of all the granular day-to-day accounting issues and provide them with actionable management information. Our whole proposition is focused upon adding value, using a pyramid model of accounting and financial management. Removing all the mundane detailed bookkeeping tasks from the bottom of that pyramid; produce management reporting in the middle; and most importantly, advising in a Finance Director capacity at the top.

Most of our clients are under-resourced in the financial area and often inexperienced. They focus on what they do best while we support them at both a foundation and advisory level that optimises the business opportunity for them.

There are plenty of bookkeeping businesses dressed up as outsourced finance facilities, but the reality is that they don’t have the advisory capabilities or the technical infrastructure to be truly connected, and on the pulse with their clients. This is one of our key differentiators and why the technical aspect, the backbone of our offering, is so important to our business model and our client’s businesses.

What led to your decision to change Finance systems?

We were with our previous software for 15 years and have been an advocate for the system for the vast majority of that time. However, the past few years have seen an acceleration in technical and software offerings available and we felt as though that system wasn’t keeping pace with the market. That being said, having looked around the marketplace, I was surprised to see how little there was on offer, in the way of true SAAS based propositions for the small to medium sized business. Obviously Xero takes care of the very small businesses and the likes of Netsuite and SAP for the very big companies… but for a serious user like us, or businesses with a few ten’s of staff, I couldn’t see anything but a sea of ‘legacy’, ‘on-premise’ offerings. Our client base was becoming increasingly sophisticated with regard to the demand for real-time information and improved ways of presenting this to them. There was a burgeoning need across many clients to feel more in control of the process and information delivery, which is relatively easy to provide in a true cloud-based solution, but quite difficult when having to use RDP (Remote Desktop Protocol) and a hosted on-premise solution.

What was your key criteria for a new system and why did you choose iplicit over the other solutions being considered?

It was a mixture of things really; we knew we had to move to cloud because all other systems are going that way too. We’ve been a Microsoft Office 365 user for many years now and we recognised the value that we’d experience, both for our customers and ourselves, in transitioning to a fully integrated suite of cloud-based services. Our business model is based on acquiring growing companies with increasing needs for a serious finance function. These companies started out much smaller, and have for some time enjoyed true cloud-based solutions such as Xero and Quickbooks. While those applications can’t service their increasing demands, these sophisticated clients took a negative view at the idea of ‘upgrading’ to a system that wasn’t a true cloud offering, even if we did provide significantly improved levels of reporting and management. The perception was it was a backwards move.

An equally important factor in choosing a new system was to evaluate the type of relationship that we would have with the provider. Our finance system is not only the backbone of our business but it’s at the heart of our offering for every single client. It is the very thing that our business proposition is based upon; timely information and effective reporting. Therefore, customer support, client service and trust played a big part in our decision-making.

We researched the marketplace and evaluated offerings like Sage 200, Access and Opera… and they all appeared to suffer the same problem; being based on old technology that is on-premise by design, with functionality built ‘around’ each offering rather than ‘within it’. Even the hosted ones didn’t seem to offer a true SAAS proposition. Therefore, we didn’t find much in the market place that was encouraging us to move from a technical standpoint, but we felt we had to do something because of the

lack of relationship with what should be our key business partner.

We felt totally stuck and couldn’t see a way forward without spending significantly more on a corporate system that would be far too ‘big’ for our needs. Yet technology had become such a core part of our business that clients were expecting us to ensure the smooth running of the IT infrastructure that connected us. This expectation became increasingly onerous and another factor in forcing us to continue to search for something that could lessen our burden in this department too.

And then we found iplicit!

What is Insight’s core business proposition?

Primarily, Insight Associates delivers a turnkey Outsourced Finance Department; we run the entire finance and accounting functions on behalf of all our clients. We focus upon high growth businesses that are moving quickly and we remove the burden of all the granular day-to-day accounting issues and provide them with actionable management information. Our whole proposition is focused upon adding value, using a pyramid model of accounting and financial management. Removing all the mundane detailed bookkeeping tasks from the bottom of that pyramid; produce management reporting in the middle; and most importantly, advising in a Finance Director capacity at the top.

“Could I have an ‘I Love iplicit badge please?’ The experience we’ve had with you guys so far has been second-to-none. It has been an absolute delight. I can’t fault the desire on the part of the iplicit team to help find a solution, no matter what the challenges were during the migration.”

So you’ve moved from a hosted on-premise system (fake-Cloud) to a True Cloud system – what do you see as the main benefits of one over the other?

If I could, I’d like to turn this question on its head and look at the disadvantages of a ‘fake cloud’. There are other ways of doing things, but in our set-up, we were dependent upon Microsoft’s RDP technology and in our experience, it certainly wasn’t an ideal way to work. There was a need for a client app on the machine our client wanted to connect from, which immediately eliminated the flexibility of being able to access the system from a browser. This also added another step in the process before being able to access the software. Security was quite an issue too, given we had to facilitate work-arounds for peace of mind. With our old system, the solution to providing a user interface for the non-accounting user, was through a mobile app.. And while we use an IT services provider to support us and are very pleased with the level of service they’ve given us over the past 20 years, we still have some clients that have connection failures. In these situations, even when it isn’t our fault, the responsibility falls at our door because we’ve provided a fairly complicated level of technology as a work-around for accessing something that really was designed for on-premise only.

Having everything integrated into one system, with one interface and none of the access restrictions or security concerns was a massive step-up in capability and significant reduction in burden on the business. Now, we have greater peace of mind, fewer support issues and a user experience that is a world away from what our team and clients have been used to.

Has iplicit changed the way you work and if so, what benefits have you seen?

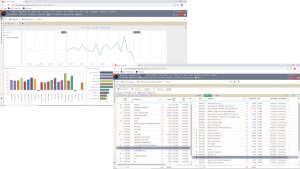

Initially, it was the removal of all the hassle and the responsibility that we had become accustomed to over recent years. But once that became our new modus operandi, our focus then turned towards the additional services that we could deliver to our client base, and with relative ease. We are excited about the prospect of looking at things that were very difficult to consider before; historically it would have meant investing in something new – another bolt on – or it just wasn’t available for us to buy. Things like real-time reporting, dashboards and workflow in iplicit are all features that we feel will have a material impact on the effectiveness of our clients’ business processes and decision-making.

Already, we are discussing with our clients implementation of new workflows involving time-sheets, purchase ordering, document flow and invoice approval; some of which we were providing elements of with our old system, but now the quality of our offering, and the extent to which we can tailor it for each client’s workflow, has been transformed. I think it’s fair to say that historically, we weren’t able to deliver all of the requirements that our clients were demanding.

Another major benefit we’ve seen is the signing of a new client in the last few weeks, which we would not have been able to provide a solution for, if it wasn’t for us now running with iplicit; the way they needed to run with selfbilling, timesheets and associated real-time reports, would not have been possible without a comprehensive true cloud-based solution.

Changing finance systems can be quite a daunting prospect. What have you learned through the transition and do you have any advice for other on-premise system users who are considering making a change?

I think it all comes down to planning. A metaphor I’ve used many times, when advising on changing any type of technology infrastructure within a business, is that of painting a house! On the face of it, it seems pretty easy to slap a new coat of paint on top of the old one. But we all know that the real longevity in the job lies in the preparation; rubbing down the wood, removing all the old paint, filling in the holes beforehand, priming an undercoat… then, not only when the paint goes on, does it go on easily, but it also lasts. This is very similar to the issues when migrating to a new finance system. Spend your time preparing – what you want to achieve, thinking it through, understanding what the new system is capable of and how you might make best use of it. Making sure it isn’t rushed.

In our migration, we decided that we’d break it down into two major segments, firstly replicating the existing solutions’ functionality and minimising the change at the point of transition. Then secondly, exploiting the new system’s capabilities, such as workflow, once we have all become accustomed to the new way of working. This enabled us to move more quickly and not try to do everything at once.

“iplicit ticked all the boxes for us and we’ve not looked back – my entire team is still raving about it.”

Garry Mumford, Founder & Managing Director at Insight Associates

Have you found any particular benefits in having more of the functionality you need within one integrated system?

Having all the functionality in one place is massively beneficial. We had an awful lot of things hanging around the edge of the old system. But now with one consistent interface and sign-in, it’s so much more manageable. Structurally, it also works a lot better and suddenly, database synchronisation is a thing of the past.

What is your favourite feature of the new iplicit system?

I’m sure that some of my staff will have a different opinion from me because there are so many to choose from. I’m not using the system in anger every day like they are, but for me I think that drag and drop is fantastic! This is something we couldn’t do within an RDP environment, whereas now, if we want to attach a document to a transaction, we just drag it on – that’s another real step-change.

How is iplicit going to help grow your business?

We are certainly looking to grow and I believe that our new technology proposition will be a key factor in facilitating that growth. No longer will we be in a position of trying to convince a prospect that our finance system isn’t a step back in time. Only last year, we lost a piece of business that could have been really valuable to us, and it was only afterwards that we learned that their primary concern was the on-premise system we were using. The prospect told us that in the event they wanted to move their business away from us, they would need to install their own system and variety of bolt-ons that we are using, in order to replicate our service – this was a path they didn’t want to go down as they felt it to be too onerous. However, now with iplicit, I can explain to clients and prospects alike, that if they ever wish to move away from our outsourced offering, it would be as simple as signing up with iplicit directly and everything they’ve been used to will be immediately available in the cloud for them.

This level of confidence in our infrastructure, encourages a greater level in confidence from our clients and our suppliers – they realise that they are with us because they want to be, not because they are locked in. In addition, we will save a great deal of time, effort and money from switching systems, no longer having to worry about hosting, IT services and support for the old system and various bolt-ons. I think that everything will migrate to cloud in time. No one buys software anymore, it’s all for rent – I like the idea of paying for something monthly and knowing that it’s always up to date and we have the latest versions for everything. We’ve been doing it for years with Microsoft and to think back to the days when we would have to fork out thousands for an Office update every few years; that was just bonkers in comparison. The resulting integration that will occur, from everything moving to the cloud, will be a massive benefit to all the users out there, no matter what systems they are using.

It’s still quite a techy thing to discuss API’s and systems communicating, but some time in the not too distant future, I think this will be much less of a techy issue and all systems will communicate more seamlessly.

Anything else you’d like to say?

Could I have an ‘I Love iplicit badge please?’ The experience we’ve had with you guys so far has been second-to-none. It has been an absolute delight. I can’t fault the desire on the part of the iplicit team to help find a solution, no matter what the challenges were during the migration. I have been used as a reference site for many prospects who are considering an upgrade from their existing system to iplicit; all of them ask about the level of support. I say the same thing each time – ‘I wish everybody in the industry had an attitude like iplicit’.

If you would like to get in touch with Garry directly, please contact him via LinkedIn or alternatively visit the Insight Associates website.

Don't Take Our Word For It

Here's What Our Customers Say

Profiles Creative

Lee Cook

“Bring vibrance to your site by setting color & transparency with our color overlays options. Simple & stylish. Bring vibrance to your site by setting color & transparency with our color overlays options. Simple & stylish.””Bring vibrance to your site by setting color & transparency with our color overlays options. Simple & stylish.”

Third Energy

Ruth Motley

‘We looked at a number of systems in the marketplace including NetSuite, SAP, Sage and iplicit. It came down to a choice of two systems in the end, because NetSuite was unresponsive and Sage 200 seemed like a step backwards. While SAP was interesting, it was just too expensive and iplicit delivered everything we wanted at much less cost.’

Trees for Cities

Annabel Kiddle

‘We now use the workflow authorisation functionality, so everything can be done electronically now. Previously we used to have to get people to physically sign things off and then email their approvals. With the new iplicit system, all the documents are accessible digitally, at the point of approval, so the process is remarkably faster.’

(+ 353) 1 592 0850

(+ 353) 1 592 0850 (+ 44) 20 7729 3260

(+ 44) 20 7729 3260