SORP, SOFA, and Fund Reporting

Backed by over 30 years expertise in successfully delivering Accounting solutions in Ireland and the UK

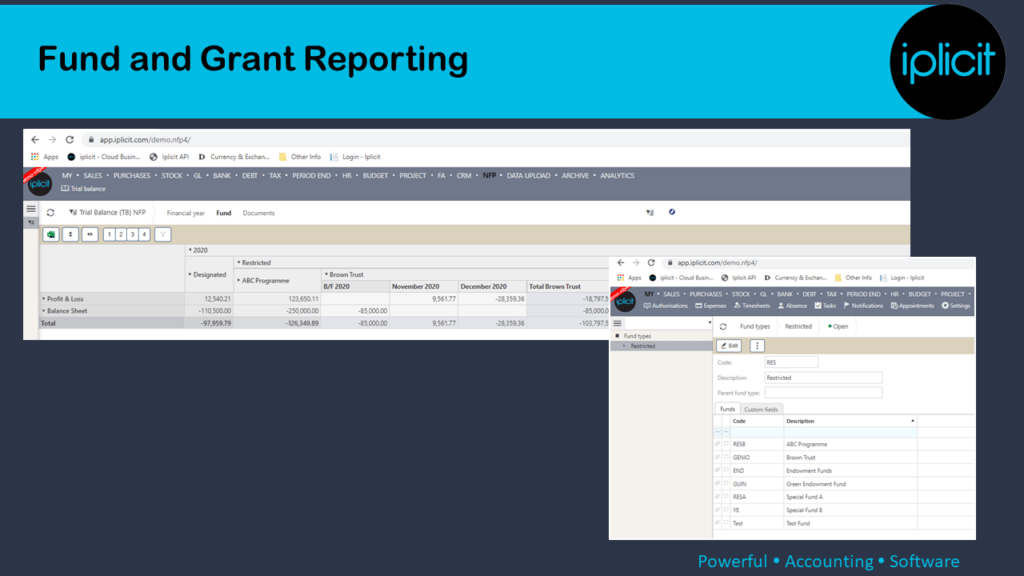

Integrated Grant & Fund Reporting for Charities and Nonprofit organisations

The needs of Charities have always been close to our heart after 25 years in delivering software solutions to charities in Ireland and the UK. Iplicit has been designed to incorporate the diverse and essential requirements of charities of all sizes. Our fund and grant management, restricted fund reporting, and comprehensive and unlimited levels of analysis enable organisations to see and manage their funds and grants and all related usage and expenditure.

These grants and funds can be further segmented by fund type, restricted and non-restricted, and accruals and disbursements. Seamless SOFA and SORP reporting is available as standard, and can easily be configured to suit your own unique reporting and General Ledger structures.

Monitor costs and funds, easily report to donors, trustees, patrons, management and regulators with confidence and without cumbersome manual intervention.

Essential reporting on fund and grant receipt and expenditure

iplicit is designed to empower charities and other nonprofits to have full visibility on their budgets and spending, which puts them in a provable and secure position to compete for grant funds and have full transparency on their income and expenditure.

Donors or grantees understandably are more particular on the level of transparency and accountability in each recipient charity and have far greater expectation on the level of reporting on how their funds are put to use. iplicit’s unique inbuilt grant tracking software removes the burden of having staff spend hours working in spreadsheets to show where grant awards have been utilised after the fact.

If your organisation cannot produce appropriately detailed and timely key financial reports, it may find itself missing out on opportunities for funding.

iplicit’s nonprofit cloud-based accounting software provides the most instantaneous and accurate financial data in real-time saving you days every month on fiscal governance and fund accounting.

Unlimited Fund analysis attributes for the most complex charities

Unlike other general accounting software, iplicit offers an unlimited number of grant, analysis and accounting dimensions within each legal entity to enable you to easily analyse your transaction entry as you process your data, leading to instant on screen financial updates.

More often, funds providers demand more than after-the-fact static reporting in Excel.

They require comprehensive budgets and forecasts for each fund, and each project within a fund, and rolled over from year to year together with transactions, records, accompanying copies of invoices, and detailed line based analysis against all spend and projections.

Having the ability to demonstrate such prudent and secure fiscal workflow systems provides assurance to funders, service users, staff, and regulators alike.

Diverse reporting for disparate stakeholders in real time

A nonprofit organisation is expected to be able to easily produce financial reporting for multiple and diverse stakeholders whether that is management, trustees, funders, charity regulators, Revenue, auditors, or project managers. Often, these stakeholders will need the information sliced and diced for their unique needs and responsibilities, and all from the same transaction entry fields.

iplicit makes it easy for you to create and adapt dashboards and reports to meet the needs of the diverse reader – inside iplicit with full drill down, or via live links to Excel, or even external BI API links.

Project accounting and analysis

Since iplicit gives you unlimited fields for entering information, you can record progress against targets and attach documents that show the positive effects your grant funding is having.

Our flexible project accounting functionality provides extensive analysis on your project forecasts, expenditure, and overall results instantly on screen.

Timesheets, purchases, expenses, or off-sets can all be coded to each project together with all related documentation, notes, and workflow histories. The addition of unlimited analysis fields ensure the most complex reporting needs can be facilitated as your needs evolve over time.

FREE TOOLKIT GUIDE

How to successfully change your finance system: A toolkit for nonprofits

Authored in partnership with Charity Finance Expert, Mark Salway FCA, iplicit have produced this guide to help nonprofit organisations to understand why and when they need to consider changing their accounting and finance software and processes, and more importantly, to ensure that such change is successful.

Digital transformation and the introduction of new software and processes can make an amazing difference if selected and implemented well. With our decades of sector experience we have produced this as a simple yet effective ‘how to’ guide to better system choices and implementation best practice.

Trusted by Charities and Nonprofits Across Ireland and the UK

Read Our Reviews

Find out what others have to say about iplicit read our customer reviews.

Don't Take Our Word For It

Here's What Our Customers Say

Insight Associates

Garry Mumford

‘Could I have an ‘I Love iplicit badge please?’ The experience we’ve had with you guys so far has been second-to-none. It has been an absolute delight. I can’t fault the desire on the part of the iplicit team to help find a solution, no matter what the challenges were during the migration.’

Third Energy

Ruth Motley

‘We looked at a number of systems in the marketplace including NetSuite, SAP, Sage and iplicit. It came down to a choice of two systems in the end, because NetSuite was unresponsive and Sage 200 seemed like a step backwards. While SAP was interesting, it was just too expensive and iplicit delivered everything we wanted at much less cost.’

Imperial Society of Teachers of Dancing

Keith Stephenson

“Being able to rehearse workflows and play with configurations, without risk, has been invaluable to us and also serves to make us much more confident with customisation.”

Home » Key Features » SORP, SOFA, and Fund Reporting

(+ 353) 1 592 0850

(+ 353) 1 592 0850 (+ 44) 20 7729 3260

(+ 44) 20 7729 3260